Yuan gets boost from London partnership

2014-06-18 10:58:28

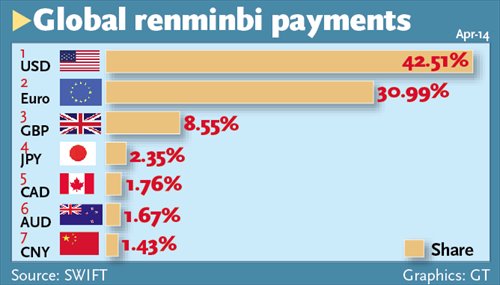

Global yuan payment

The London Stock Exchange Group (LSEG) signed agreements with two Chinese State-owned banks on Tuesday to boost offshore yuan trading in the UK.

A partnership with Bank of China (BOC) will allow the LSEG and the lender to jointly assess and design yuan clearing and financing processes for future yuan-denominated products, the LSEG said in a statement posted on its website on Tuesday. The BOC, China's third-largest lender by assets, will work toward becoming a member of the LSEG, it added.

In a separate statement, the LSEG said that it formed an alliance with the Agricultural Bank of China to facilitate access to capital by Chinese companies through LSE's Primary Markets operations and to support investor education and awareness programs in China and the UK.

The signing of the agreements coincided with Chinese Premier Li Keqiang's five-day visit to the UK and Greece. Li, who is China's top macroeconomic policy and financial reform architect, was expected to heavily promote the internationalization of the yuan during his trip.

China Construction Bank, the second-largest lender in China by assets, will become the first clearing service center for the yuan trading in London, the Financial Times reported on June 11 citing unnamed sources. Li would announce the deal when he is in London this week, the newspaper said.

Liu Xiaoming, Chinese ambassador to the UK, said on Saturday that Li will sign some 40 deals worth more than $30 billion during his visit to London. The deals will cover sectors including finance, investment and high-technology, Liu said.

The agreements and the reported establishment of a clearing service center will be "a landmark first step for yuan to break into the European market," said Dai Shugeng, an international finance professor at Xiamen University.

"China will be able to shorten the process of internationalizing its currency by at least 10 years, if it can tap into the European market," Dai told the Global Times on Tuesday. "London is a good place to start, because it is experienced in handling offshore currency trading and the performance of its financial market has strong impact on eurozone countries."

Chinese companies and authorities have made a raft of moves to boost offshore yuan trading this year. On January 5, BOC's London branch issued 2.5 billion yuan ($401.39 million) worth of yuan-denominated bonds in the city. And on April 10, the Shanghai Stock Exchange said it had approved a scheme that allows mutual trading of Shanghai and Hong Kong shares, a move that would boost offshore yuan trading in Hong Kong.

Zhang Lei, a macroeconomics analyst with Minsheng Securities, told the Global Times on Tuesday that the yuan needs to be used more often during trade settlements before it could become a global currency.

Only 1.43 percent of payments were made in the yuan in April, ranking it the seventh most-used currency in the world, according to the Society for World Interbank Financial Telecommunication on June 3. Some 0.63 percent of transactions were made in the yuan in January 2013, it said.

Derek Sammann, a top executive of the Chicago Mercantile Exchange, one of the world's largest derivatives markets, told the Global Times in a previous interview that demand for offshore yuan products, including options, futures and swaps, will grow in Europe and the US.

Zhang agreed with Sammann, noting that the yuan-linked financial products will gain popularity in the long run. "China's economic growth, despite slowing, is fast compared with developed countries and yuan will appreciate in the future," he noted. "These factors will fuel growth in the demand for yuan-linked products."